Since 2016, the build-up to Brexit has been a figural thorn in the side of most UK and EU eCommerce businesses, brands, and retailers. If you’re like most people in the UK or EU, you may need some more help and clarification with the Brexit trade deal changes that took place on January 1st, 2021. We want to give you a Brexit deal summary so that you can understand the ins and outs of the latest Brexit news, the Brexit consequences, and the new Brexit rules. What are they exactly? What do they mean? How are they going to affect my business? When can I stop pulling my hair out?

As if Covid hadn’t complicated things enough, now Brexit is here to stay and complicating business just a little bit more. Covid fatigue is real, and so is Brexit fatigue. Many feel unprepared for the changes. In fact, a new report reveals that 76% of small businesses feel unsupported and confused. However, it is important to understand these recent changes to prepare for things like the Brexit VAT changes, EORI numbers, and customs preparation. This includes UK retailers, UK ecommerce platforms and companies, and UK logistics companies. Paakpod aims to help businesses understand and adapt to these changes, and we are always available to speak to you personally about this if you’d like to setup a call.

Table of Contents

ToggleWHAT IS BREXIT?

So, what exactly is Brexit again? Well, the literal Brexit (Britain’s exit) definition means that the United Kingdom (UK) officially withdrew from the European Union (EU), a union of 27 member states throughout Europe, adapted in 1950 as a means for Europe to unite and prosper socially, and economically. The EU had its own set of membership costs, tariff regulations, and agreements. Now that the UK has left, new laws apply to selling and shipping between the UK and the EU. That means new regulations, services, import tax, and customs declarations.

Whereas before the UK remained within the EU customs and VAT systems, now that it has changed and there are new customs formalities. The new Brexit costs and changes apply to merchants and buyers in the UK, in the EU, and abroad. As this process is ongoing, ensure that your business is staying updated with the latest Brexit news. The Team at Paakpod work hard to make sure our clients understand these changes and Brexit consequences to ensure a seamless process for their business.

WHAT ARE SOME OF THE MOST SIGNIFICANT BREXIT CHANGES FOR SELLERS?

Up until 2021 selling online and shipping was relatively easy. When your EU customers made an order, they were fulfilled by a UK warehouse and moved across the border in a timely and efficient manner without too much hassle or worries of extra costs. When UK eCommerce customers placed an order, the same process was also smooth from the EU to the UK.

NOW, SOME OF THE MOST SIGNIFICANT BREXIT CONSEQUENCES AND CHANGES FOR SELLERS BASED IN THE UK AND EU THAT COULD SLOW THIS PROCESS INCLUDE:

1) Customs Forms – Sending products from the UK to Europe now requires custom declaration forms CN-22 and CN-23. For items with a value up to £270, use customs form CN22. For items with a value over £270, use customs form CN23. You can access more information about UK customs here. The UK government has advised it would be useful to hire a customs broker, freight forwarder, or similar entity to help with customs relating to importing and exporting.

2) EORI Numbers – Now, because the UK is no longer a part of the European Union, you will have to get an EORI number from HMRC (Economic Operator Registration and Identification Number) to move goods between Great Britain and the EU. It is now necessary for both customs and UK VAT documentation.

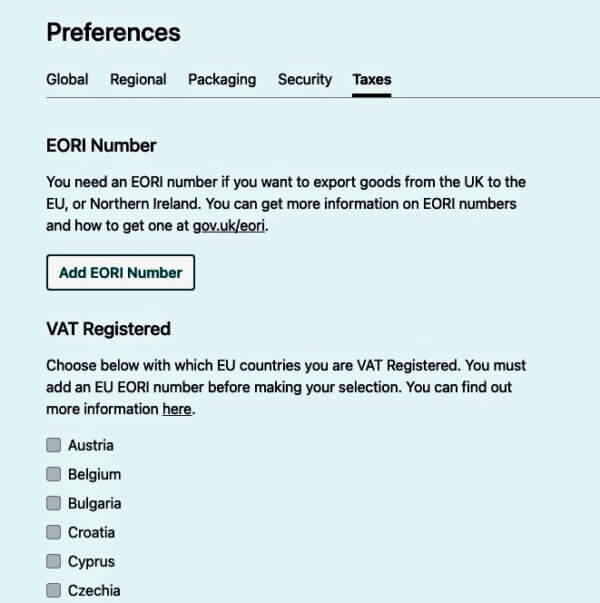

Your business needs to make sure to include, if necessary, the EORI numbers on your customs documents or you will face increased delays and potential further costs. Not doing this will cause more kinks in your supply chain, so make sure to take care of this important task ahead of time. PaakPOD makes this easy because our platform automates all customs paperwork and delivers it electronically to the relevant courier networks. Adding your EORI numbers is easily done on the PaakPOD platform, as shown below.

3) Special UK Export License – After December 31st, 2020, the Export Joint Unit (ECJU) has new requirements of controlled items. There are goods that may require a UK export licence and/or certificate. Some of these items include: Chemicals, goods, excise goods, livestock, and foodstuffs. See the list here.

4) Northern Ireland: Northern Ireland has a dual position in the EU Customs union. According to the Northern Ireland Protocol, this means that UK authorities apply EU customs rules to goods entering Northern Ireland. The

aim of the protocol was to avoid a hard border on the island of Ireland. This means new systems for traders, electronic administrative processes, declaration requirements, and security information for goods entering Northern

Ireland from the rest of the UK. You will need an EORI number to move goods from Great Britain to Northern Ireland, however at this time it is unlikely you will need an EORI number from Northern Ireland to Ireland.

For Northern Ireland (NI) trade with Great Britain (England, Wales, Scotland), this is still treated as a domestic UK transaction. UK VAT is also still applied. Goods moving between Ireland and Northern Ireland are unchanged and will be considered as movements across internal EU borders. Check your EORI validation, EORI number format, and EORI checker here.

BREXIT VAT CHANGES

Now that we have a Brexit trade deal, and the UK is no longer a part of the EU, things aren’t as simple as they were with the previous EU Customs Union. Now sellers will need to consider paying custom tariffs, identifying HS and commodity codes, completing customers declarations, and managing increased UK VAT changes and liabilities. How VAT is accounted for has changed, and the UK VAT changes affect trade with EU and non-EU countries.

As many of us know, the value-added tax (VAT) charge is a tax on the UK’s goods and services, reported to HMRC. The UK is continuing to levy VAT after Brexit, as the same rules apply for domestic transactions. Prior to Brexit consequences, the UK was part of the EU VAT regime which was an

EU added tax on goods and services with the European Union.

To be clear, you will now pay VAT on goods sent from the EU and non-European Union countries and special territories (e.g. the Canary Islands) if they’re:

-

- Gifts more than £39

-

- Other goods worth more than £15

-

- Alcohol, tobacco products and fragrances (eg perfume, toiletries, and cologne) of any value

You will have to pay VAT on all goods sent by mail order from the Channel Islands no matter what their value.

You’ll be charged at the VAT rate that applies to your goods. VAT is charged on the total value, including:

-

- The price paid for the goods

-

- Postage, packaging, and insurance

-

- Any duty you owe

Recognising the potential for slower operations at UK customs post Brexit, the UK has now introduced a deferred import VAT scheme in lieu of VAT payable upon import. This scheme was created so no in person cash VAT payment must be made by business importers to UK customs. This lets you account for the VAT on your VAT return, rather than paying it immediately (e.g., at the port of entry). This is known as Postponed VAT accounting (PVA). However, the postponed VAT accounting scheme is optional. If you wish to pay the VAT upfront when the goods enter the UK (at the port of entry, for example, or after release from a customs warehouse), then you can.

FOR SELLERS SHIPPING GOODS FROM THE UK TO THE EUROPEAN UNION:

UK sellers will have to consider VAT registration in each European country you are selling to. EU VAT is payable on the goods when they enter the EU.

To be clear, if you are a UK seller, you do not want to charge VAT for EU or ROW orders customers at checkout. EU customers will be asked to pay VAT and duty on delivery, so you don’t want to be double charging them.

FOR SELLERS SHIPPING GOODS TO THE UK FROM THE EU:

Similarly, EU eCommerce sellers now have to consider the Brexit consequences of UK VAT As of January 1st, 2021. If you send goods as an EU seller to the U.K., above £135, you will pay import VAT with HMRC. No customs duty or import VAT will be added below this. Sellers sending goods to the UK will need to apply VAT at the point of sale, rather than applied as import VAT at customs. Some customers have already dealt with very surprising charges of these Brexit consequences.

According to an article published by The Guardian, customers in Europe buying products ranging from furniture to pet food from UK companies are receiving unexpected bills for VAT and customs declarations. One couple said that “we bought a £42 shelf for their bathroom, and on the morning, it was supposed to be delivered, we received an import duty/tax demand for over €30, like a ransom note. It was a complete surprise.” Headaches like this seem to be on the rise with the new Brexit VAT changes, so make sure your business adjusts accordingly. Follow any of the latest Brexit updates around VAT here.

Because the UK abandoned the EU VAT Regime on December 21st, 2020 and then introduced the deferred import VAT scheme (PVA), this will enable importers to account for and recover import VAT as input tax on the same periodic (usually quarterly) VAT return, rather than having to pay it upfront and recover it on a subsequent return using the C79 VAT certificate as evidence of entitlement.

VAT MOSS BREXIT CHANGES

The UK left the EU VAT regime on December 31st, 2020. If you sell digital goods in the UK to EU customers, then you can no longer use the Mini One-Stop Shop (MOSS) single VAT return with HMRC to report your sales to your EU customers and pay over EU VAT. You will need a new VAT registration to avoid any fines on taxes due to Brexit changes. Selling across the border to UK and EU consumers include things such as: Software, e-learning, e-books, downloadable media, streaming media, dating & membership websites.

-

- For UK sellers that have UK eCommerce websites and sell to the EU, apply now in any EU member state for a MOSS registration number under the Non-Union MOSS scheme. You will be able to use this to report quarterly sales to EU27 states.

-

- For EU sellers that have EU eCommerce websites, selling to the UK, you should apply now for a UK VAT number to report any sales to UK customers on a quarterly basis. There is no threshold for this. All UK sales must be immediately reported to the UK’S HMRC.

-

- For US sellers with US eCommerce websites, if you are registered in the UK for your pan-EU electronic services, you can no longer be able to use that for EU or UK transaction reporting. You will need a new EU MOSS registration. You will also need a new UK VAT registration for the UK.

DEFER DUTY PAYMENTS FOR UK SELLERS

If your business imports goods regularly, you can now apply for a duty deferment account to delay the payment of many customs charges. This applies to

-

- Customs Duty

-

- Excise duty

-

- Import VAT

By creating a duty deferment account, it allows your business to make a one-time payment a month through direct debit instead of constantly paying for individual consignments. Most people who qualify for a duty deferment account are importers or someone who represents them. You will receive a duty deferment approval number if your application is successful.

ZERO VAT RATE

Depending on the type of goods you deal in, zero rated VAT items are goods that will be classified in VAT categories, but that rate is set to zero. These types of supplies are items such as children’s clothes and footwear, water, basic foods, books, and newspapers. So, check if you qualify for zero VAT rate.

Also keep up to date on Brexit consequences with the UK VAT calculator.

COMMODITY CODES

Understanding the classification of goods so the correct tariff and quota can be added must be correct. Commodity codes (CC) consist of eight digits for your goods and 10 digits for goods you import. Luckily, the UK still uses the same codes used in the EU.

These numeric codes can be found in the system with the World Customs Organisation. See here for commodity codes UK.

THE PROCESS

To summarize, here are the steps for submitting customs when exporting goods from the UK to EU countries.

1) APPLY FOR AN EORI NUMBER

2) KNOW THE COMMODITY CODES OF YOUR GOODS

3) FIND OUT ABOUT LICENCE OR OTHER SPECIAL REQUIREMENTS

4) CHECK IF YOU FULFIL THE CONDITIONS FOR ZERO VAT RATE

BREXIT TARIFFS

What are tariffs again? Well, more tax liability, unfortunately. Tariffs are a type of tax paid on imports, charged by the country to which the import is made, separate from VAT. Tariffs in the UK are payable to HMRC. These tariffs are calculated by the commodity code. The rules that applied before Brexit from non-EU countries now apply to imports from the EU.

Many people assumed a post Brexit tariff-free trade deal; as it seemed from the information we were given; however, it seems there are still tariffs on some goods. Customs duty (tariffs) will apply to some goods and excise duties will continue to tobacco, alcohol, and certain energy products. Also, for some products outside of the UK and EU. For example, if more than 40% of the goods pre-finished value is neither of British or EU Origin, there will also be tariffs.

This specifically means that a tariff will be added if the goods originate from places such as China or Japan (where many goods and drop shipping comes from). The Brexit deal fine print on this issue is not great for companies who choose to source products from those regions. For example, if you want to export clothes from the UK to the EU, it won’t ‘qualify as tariff-free if the items were originally from China. Like many other products, they do not qualify anymore for zero rate tariffs under the Brexit agreement. The cost of this tariff will have a substantial impact on many UK companies.

The good news, however, of these Brexit consequences is that China will benefit from many zero-tariff benefits for many of its products coming into the UK. China is estimated to be the third-largest import partner to the UK, estimated at 10% of the market. See the UK global tariff list here.

Other tariffs will vary depending on the type of product being brought in. Therefore, it’s crucial for exporters to include the correct commodity code for their products. Using the government’s website look-up-tool, you can look up commodity codes, duty, and VAT rates.

Tariffs will apply to all goods imported into the UK unless:

-

- The country you are importing from has a trade agreement with the UK

-

- An exception applies, such as a relief or tariff suspension

-

- The goods come from developing countries covered by the Generalised Scheme of Preferences

WHAT DO THE BREXIT CONSEQUENCES MEAN FOR THE FUTURE OF E-COMMERCE?

Rest assured that online shopping in the UK is massive. The UK is the third-largest eCommerce market in the world, accounting for 19% of total retail, making it worth over £200 billion. The momentum is there, and it will not be slowing anytime soon. In a post-COVID-19 world, UK eCommerce will continue its massive growth, and nothing will change that. To ensure the promising future of eCommerce, the customer experience must be the centre of attention.

With increased border delays, this could potentially slow the industry and supply chain’s, negatively impacting a positive customer experience. The way forward from this is to move beyond those hurdles by predicting them, preparing for them, and surpassing them with smarter systems and predictive processes.

Now, the UK government has introduced measures to reduce the impact of Brexit consequences on businesses, but these new changes do mean tough new challenges for businesses of all types. You must do an immediate review of your supply chain and assess potential damages and losses. Look at the EORI number, VAT reporting, payments, etc. You may need to update your IT/software services provider, and if it would be beneficial to switch to a 3pl service provider.

Understanding the Brexit consequences for UK eCommerce is critical. Retailers should reconsider how to optimize their UK order fulfilment by avoiding bottlenecks at customs. Prolonged delivery times from UK online shopping will deepen the impact of Brexit on the UK economy. Outsourcing your order fulfilment for UK online shopping sites can help you successfully navigate the standards and expectations of your customers in this post Brexit era.

DISCLAIMER

The information provided on this website is for general information purposes only and does not constitute professional advice.

No reference to or mention of any website, link, event, conference, document, or other sources of information of any third party by Paakpod on this or any other Paakpod website or otherwise shall constitute any recommendation or endorsement of any such website, link, event, conference, document, or other sources of information.

Paakpod isn’t liable for any loss, damage, security breach, cost or expense incurred by any person relying on any such information or document, accessing any website, or attending any such event or conference.