If a global pandemic wasn’t already enough to deal with – looks like it’s time for another worldwide disruption. You may have noticed that inflation has been on a steady rise over the last year – and it’s affecting people and businesses everywhere. The Bank of England predicts that inflation will be up to 11% within months, the highest rate for 40 years in the UK. Globally, prices are rising for everything from food to everyday products and energy costs. Now is the time to audit your accounts department and scrutinize your incomings and outgoings. The rising costs of inflation on eCommerce sellers are a huge burden. However, even though we are in a very volatile market, there are still many ways to remain profitable – and 3PLs can help alleviate the strain of rising costs and inflation levels.

Economic frugality requires making challenging decisions about where to axe costs – but it also means re-evaluating operations in general. Though seemingly negative, financial strain and deciding your operations moving forward can bring innovation and a surprising surplus of cash. In these challenging times, businesses tend to wait until the last minute to focus on the liabilities of their business. Conversely, some businesses simply prefer to hunker down and wait it out – keeping them treading water and remaining stagnant.

If you’re overspending on internal operations with your online retail business, it may be time to switch to a 3pl. This article is for you if you are a medium-level or large enterprise business with monthly orders between 2,500 – 10,000 or more. Let’s discuss how 3PL fulfilment can cut your costs and help safeguard your operations against inflationary pressure and rising costs.

HOW DOES INFLATION AFFECT MY ECOMMERCE BUSINESS?

One aspect of inflationary factors affecting eCommerce businesses everywhere is when there is an unhealthy balance of supply and demand. Currently, much of the inflation is due to a turbulent supply chain infrastructure. During inflation, the price of “stuff” naturally increases over a period of time. This includes commodities like the price of raw materials, goods, and production costs.

We saw this trend largely during Covid when online retail skyrocketed. Suddenly, businesses had to compensate for the new demand, but supply operations were still in limbo – plus, many factories were shut down or only operated on a limited capacity. We still see this trend today as fewer people occupy the logistics workforce worldwide. So, as inflation increases, companies need to find ways to cut their costs and increase productivity. You may be one of the online retail businesses still struggling to meet demand.

Table of Contents

ToggleSome of the biggest issues for eCommerce businesses currently include:

- The rising costs of goods

- The rising costs of utility bills

- The rising costs of employees

- The rising costs of transportation

A thorough understanding of internal and external supply chain operations and the effects of inflation on them is particularly important for companies. A company that can understand the daily and long-term changes in its operating environment will be able to capitalise on opportunities and avoid potential problems. One way that companies can benefit from this knowledge is by using it to develop effective supply chain strategies, which can help minimise costs and maximise customer satisfaction.

THE RISING COSTS OF ENERGY ON INTERNAL OPERATIONS

From marketing to shipping, there are many costs to running your own business. Energy is one of those costs. When energy costs go up, so does the cost of doing business. When you’re developing a budget and trying to stay within your financial means, digging deep into the details of your strategy may give you some unexpected savings.

WAREHOUSE COSTS

As energy costs rise for businesses, the cost of operating warehouses continues to increase. Rising energy costs for businesses with warehouses can affect more than just the bottom line. Electrical equipment, such as central air conditioning and refrigeration equipment may require special maintenance to ensure sustained function. Energy costs also determine the rental rates of warehouse space, which can skyrocket.

EMPLOYEE COSTS

Sellers must protect themselves against escalating employee costs that come with inflation. Employee compensation is one of the main cost drivers for retailers, as it can account for between 40 to 80% of gross revenue. In a high-inflation environment, sellers can safeguard their profits by exercising control over employee costs. Inflation creates uncertainty for sellers because the price their customers pay does not keep pace with the cost of living. As a result, sellers must raise prices or reduce wages to prevent losses in profits and cover these increases out of their own pockets.

THE RISING COSTS OF GOODS

Rising costs of inflation for goods can have a significant impact on your bottom line as an eCommerce seller. From soaring prices of materials and labour to rent, utilities, and more, covering the rising costs of inflation can be difficult if you’re not hitting sales goals. Fortunately, there are ways to mitigate these risks and keep your business moving forward.

You need to be thinking about contingency plans for running out of key inventory items, negotiating supplier contracts, monitoring key data points like inventory price rolls and shipping rates – as well as important new trends in customer value creation such as promotions and discounting.

To remain competitive in business, many sellers such as yourself will want to raise prices – passing on the cost to your consumers. There may be a better idea, however.

HOW ABOUT CUTTING YOUR COSTS? THERE ARE TWO ADVANTAGES TO THIS.

- While your competitors are price-gouging customers, you will be at the front of the line for the preferred price point – increasing sales.

- Internal audits of wasteful spending can embolden your business – allowing easier scalability.

Ecommerce sellers should protect themselves from inflation and rising costs by measuring ROI and considering automation with third-party logistics. From saving money on warehouse space to utilities and employee costs, it’s an instant win.

HOW 3PLS SAVE YOUR ECOMMERCE BUSINESS MONEY

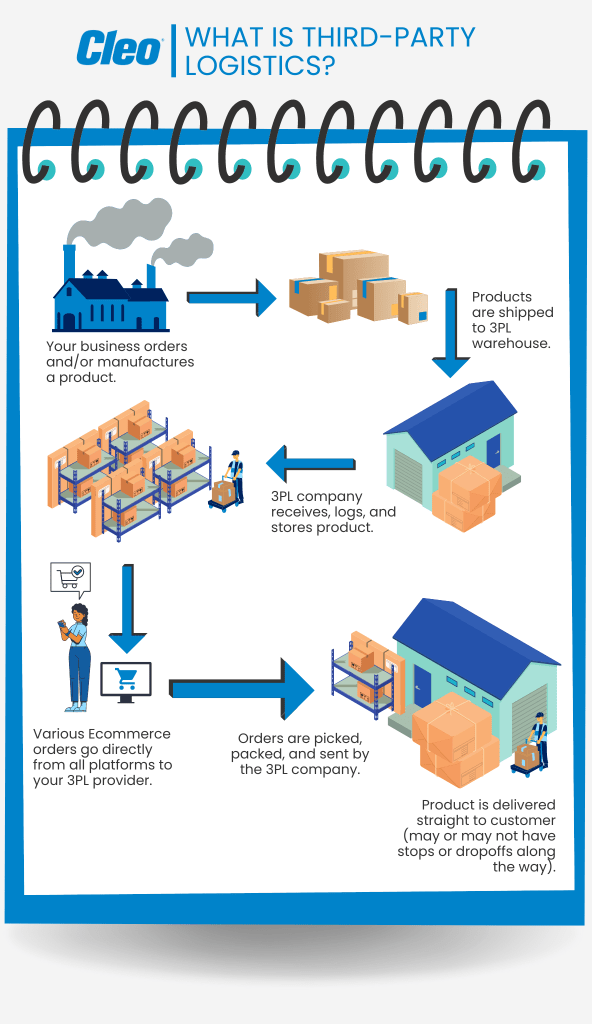

Third-party logistics (3PL) are an increasingly popular solution for companies with complex supply chains. The number of 3PLs have increased significantly in the last decade, especially after Covid – since more consumers shopped online from home.

Selazar and similar companies provide services from warehousing and transportation to distribution and inventory management. 3PLs can also help save you money by taking over supply chain operations, freeing up time and money associated with running your own logistics. 3PLs have their own warehouses, their own employees, and their own efficient systems around inventory management.

3PL WAREHOUSE COSTS

Suffice it to say that not all warehouses cost the same – however, with 3pls, there are no warehouse costs! With a 3pl, you are provided with the facility and a facility management team, freeing up valuable resources for you to serve your customers better. For medium to large enterprise-level brands, this could mean tens of thousands in savings to hundreds of thousands or more a year.

3PL ENERGY COSTS

What are your energy costs with a 3pl? Well, none. Though these types of costs may seem lower on the priority list when it comes to paying for employees and marketing, it all adds up. If you’re a large company, then these costs could be astronomical. Energy costs for using your own warehouse or facility can range from thousands to tens of thousands a year. On top of that, you also have water bills for your facilities. There is also required insurance coverage.

One of the advantages of using third-party logistics is that you will immediately pocket these costs – because there are none! What could a few extra thousand or even tens of thousands do for your business? Could you bring on some more help, spend more on marketing, and invest in more products? 3pl services allow you instant savings on your energy bills and more.

3PL EMPLOYEE COSTS

How much money could you save by not having full-time employees that also need insurance and pensions? Picking, packing, and shipping are necessary for any online retail business. Why should most of your profit go towards paying internal employees to do that when you get the same service at a fraction of the price?

For example, the current picking and packing rate for Selazar is capped at 40p a minute. The average pick time for Selazars warehouses is currently 37 seconds on average. They are quicker than most because the warehouses are digitally mapped, with algorithms dictating the quickest, most efficient routes between pickings. The average picking with packaging cost is also currently at £2.03. Employees that you don’t pay for directly still fulfill orders on an ad hoc basis. No money is wasted on breaks or lunches or overtime. The supply system simply automates for you on-demand– at a fraction of your costs.

3PL COURIER COSTS

In line with worldwide inflation, couriers naturally have to raise prices. When oil and gas prices increase, that cost is passed along to clients along the supply chain. Because couriers have strong ties with 3pls and rely on them, we negotiate rates on your behalf. Our network works with multiple carriers both domestically and internationally. Courier costs can be difficult to predict if and when we see an upward trend in rising inflation, but as an organisation, we help to mitigate such potential issues.

CAPPED RATES, VARIABLE PRICING, AND INCREASES WITH 3PLS

One of the goals and values for Selazar is to help businesses scale faster. This means keeping costs low and only paying for what is used. This means no signup fees or annual fees. There is no profit-sharing for products – unlike FBA. This also means a capped rate on picking and packing prices, meaning no increases during times of inflation.

With our bespoke pricing model, we also offer variable pricing, which allows for more cost savings rather than antiquated fixed pricing structures. As a consumption-based model, you only pay for the time for when services are rendered, rather than generic quotes based on industry average – a model ripe with inefficiencies.

When working with 3PLs, it’s important to solidify a pricing structure that benefits your business – especially in lean times. As a business owner, you have to pay particularly close attention to what you’re signing. It may feel like a daunting task, but it’s vital to ensure a fair deal for you and your customers.

Rate increases can happen for many reasons, such as warehouse leases, shipping supply, payroll, couriers, etc. Rate increases over the years tend to compensate for the cost of living, which are perfectly natural and normal. After all, you do want warehouse workers to be compensated well enough to take care of your customers. However, you should still pay close attention to the frequency of increases to get a fair deal agreed upon by all parties.

SAFEGUARD YOUR ONLINE BUSINESS TO BEAT INFLATION & RISING COSTS

While inflation will affect many aspects of business, its impact on supply chains can significantly impact sales and consumer decisions. If a business wants to grow, it will need to consider how inflation will affect its revenue and operations. This is why it’s important to know what causes inflation, how it affects businesses and consumers, and why it is so important to be aware of its effects on your operations. Should you be interested in our 3pl services, feel free to set up a free no-obligation discovery call with us today.