This new Brexit update on July 1st deals mostly with Vat Changes and the new IOSS system. However, we will also be discussing distance selling thresholds, customs changes, and the low-consignment fee eradication.

Earlier this year we published an article highlighting the Brexit changes named understanding the Brexit consequences for UK eCommerce. These changes happened on January 1st of 2021 confirming the end of the Brexit transition period. In the article, we pointed out some of the key changes such as customs declarations, EORI numbers, Brexit vat changes, and VAT MOSS changes. That was the first stage of the Brexit changes. However, there is another stage of the agreed-upon Brexit Deal that will again affect these changes. Changes on changes, not confusing at all, right? I will do my best to outline them as clear as possible for you to understand the July 1st Brexit update.

Though the UK is no longer a part of the European Union, business to and from the EU remains fluid, so knowing the new rules matters. The July 1st Brexit changes will affect retailers, marketplaces, and courier companies in the UK, EU, and abroad.

Table of Contents

ToggleThe changes also offer a good variety of VAT reforms and changes to the governance of distance selling goods for B2C services. If you’re an eCommerce business, the changes are a positive benefit for streamlining VAT transactions across borders. I will explain to you the step-by-step process for registering for the new OSS system.

You want to make sure you’re staying up to do date with these changes and decide how they will affect your business. You must consider the VAT rates, the One-Stop-Shop, as well as how and what you will be charging.

There are five major changes that I will be discussing. Those are

1) Removing distance selling thresholds for multiple EU countries for a single blanket threshold

2) Introduction of the OSS (One-Stop-Shop) Filing

3) Removing the low-value import VAT exemption and introducing the new IOSS

4) Online marketplaces deemed the seller for collecting and reporting VAT

5) Customs declarations are now required for all consignments

BREXIT UPDATE FOR DISTANCE SELLING THRESHOLDS IN EU TO A SINGLE UNIFORM THRESHOLD

The term distance selling as it applies to eCommerce means selling across borders. With the implementation of Brexit changes to selling online, we discuss some of those distance selling requirements in our article distance selling regulations and UK online selling.

When Brexit happened, and as it currently is, VAT selling thresholds vary for each European country. Now, moving forward, after July 1st, individual EU country thresholds will be removed.

Now, a single threshold will apply for the entire 27 EU member states.

The single unified threshold will remain uniform across EU member states and is €10,000 (£8,818 approximately). This accounts for all sales cross borders in the EU.

This threshold also applies to Northern Ireland, which is still a part of the European Union under the Northern Ireland Protocol.

The VAT thresholds set by each country previously have caused some administrative burdens for sellers and governmental organisations. This new unified VAT threshold will simplify the process of VAT reporting.

Along with this simplification is the implementation of the One-Stop-Shop (OSS) and IOSS (Import One-Stop-Shop) for EU and UK sellers.

BREXIT UPDATE FOR OSS & IOSS

Selling to multiple countries in the EU can make any business easily prone to accounting errors. Some of the most common mistakes include not applying the correct VAT rate to the right country, or not even registering for VAT in the first place. To simplify the declaration and payment of VAT for goods sold from a distance by sellers, the EU is introducing two new measures.

1) One Stop Shop (OSS)

2) Import One Stop Shop (IOSS)

The one-stop-shop is an electronic portal that UK and EU businesses can access as of July 1st to comply with VAT eCommerce obligations on the sales of exported goods. This system is a return of the EU Moss System that was used previously before Brexit. EU based merchants will use an OSS system different from UK based merchants.

To be specific about OSS systems, they specifically facilitate the process of collecting and declaring VAT to tax authorities for suppliers and eCommerce businesses.

1) ONE STOP SHOP

The implementation of the one-stop-shop is for selling goods and services to EU customers from EU sellers. Merchants will file a single tax return quarterly. Though EU businesses will use this, UK businesses may as well. If you’re a UK business with operations in the EU, you may need to also register, depending on your individual circumstances.

There are two versions of the OSS. Union and non-union.

UNION OSS

The Union OSS is for EU online sellers doing business in the EU. They will register with the OSS in their own member state for all intra-EU distance sales. OSS registration for EU businesses has been available since April 1st.

NON-UNION OSS

The Non-Union OSS is exclusively for online sellers not established in the EU. If you are a UK seller of “services”, this is the category you fall under. You can register for Non-Union OSS here.

2) IMPORT ONE STOP SHOP (IOSS)

The implementation of the import one-stop shop (also non-union) is for non-EU and UK businesses selling “imported goods” from outside the EU to private consumers in the EU. If you have a UK eCommerce business that sells goods to the EU, this is your category.

If the goods are less than €150, you can register for IOSS. You will be given an IOSS identification number that is unique and should be listed on all packages sent to the EU. This will ensure a quicker customs clearance process as it will show that VAT has been properly declared.

From July 1st, 2021, UK sellers will be able to use the EU IOSS.

Important note:

Non-EU businesses and marketplaces without a ‘mutual assistance’ EU agreement using IOSS must appoint an EU-resident intermediary. This is some form of a VAT agent who can represent them to use IOSS. They will share in the accounting process of VAT filings and VAT payments.

HOW DO I REGISTER FOR IOSS?

If you’re a UK seller or sell abroad, and you would like to register with IOSS, this can be accomplished by going to the website of any EU member state. Registration has already begun, and the system will be online and available on July 1st in the UK. By registering with one EU member state, you are automatically enrolled throughout the entire EU.

These new OSS systems are one of the major benefits of the new changes for online sellers. It is more streamlined and involves a lot less paperwork rather than enrolling in 27 member states!

Important note

Neither OSS nor IOSS is required. Your eCommerce business can register in the individual EU member states that you do business in.

WHAT ARE THE BENEFITS OF THE OSS & IOSS?

1) Single unified system for all EU countries – no separate filing

2) Save time on VAT reporting

2) Potential to save money on compliance costs when exporting goods

3) Reduces the likelihood of errors when reporting with automatic systems

WHAT GOODS DO THE OSS AND IOSS COVER?

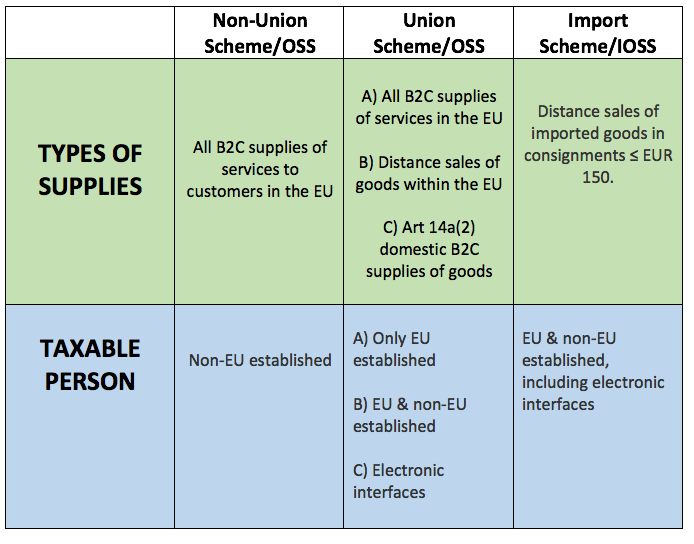

The table below outlines which system should be used for which type of supply and/or taxable person.

HOW DOES THE OSS & IOSS WORK FOR VAT?

After you register with IOSS, you will do the following.

- Apply VAT rate of the member state you’re sending goods to for every transaction.

- Collect VAT from the customer for all EU distance sales of goods.

- Complete and submit an electronic quarterly tax return via the OSS/IOSS portal.

- Make a quarterly VAT payment which you declare in the EU member state you decided to register with.

- Keep accurate records of all the sales you have made for the next ten years minimum.

LOW-VALUE IMPORT VAT EXEMPTION REMOVAL

The low-value import VAT exemption was enacted on January 1st 2021. This means that goods imported into the EU under €22 (£15) in value are exempt from both import VAT and customs duty. Anything between €22 and €150 (£135) will be subject to VAT and customs duty. Sellers with low-value consignments have benefited from this since January 1st. However, that is no longer the case.

FROM JULY 1ST, ALL COMMERCIAL GOODS SENT TO THE EU WILL BE SUBJECT TO VAT, NO MATTER THEIR VALUE.

VAT must now be charged at the time of sale (at the VAT rate in the customers country) for consignments not exceeding €150 (£135). This can then be reported via the IOSS.

WHY WAS THIS EXEMPTION REMOVED?

This scheme has been seen as abusive economically to the EU as many sellers mistakenly or deliberately under-declared the values of the goods to avoid VAT.

This new system will ensure a fairer and balanced scheme, benefiting improved trade relationships & economic impact. Sellers that repeat offend will have longer clearance times at custom checks due to poor track records. In a service-first environment speed cross-border is essential.

SPECIAL ARRANGEMENTS

Not everyone will opt-in for the IOSS system. Therefore, they may instead use “special arrangements” with their postal and customs agents instead to collect the import VAT on consignments not exceeding €150 (£135).

HOW DOES THIS BREXIT UPDATE IMPACT UK SELLERS?

Any eCommerce business that exports low-value goods to the EU will be affected by this. It is advised that you understand the ramifications of this as costs will increase. You must decide how you will handle the charges and reporting of VAT.

ONLINE MARKETPLACES DEEMED THE SELLER FOR COLLECTING AND REPORTING VAT

Online marketplaces include companies such as eBay, Etsy, Alibaba, and Amazon. If you use these marketplaces to sell and ship products to a customer, this change will affect you.

The new change is that you will no longer be considered the “deemed seller” for transactions. The marketplace you use will be the “deemed seller” for transactions. What this means is that they are now required to account for VAT on your behalf.

Is this a good benefit?

Yes, it seems it is. This saves time for you the seller and adds an extra layer of compliance for reporting with these major companies handling all the VAT details for your business.

This has been implemented to help simplify VAT compliance and eliminate fraud.

There are also new record-keeping requirements for online marketplaces facilitating supplies of goods and services

Another update for July 1st requires more record keeping for marketplaces.

What this means is that the marketplaces (eBay, Etsy, Alibaba) are now required to keep definitive VAT records of all transactions for a minimum of 10 years.

CUSTOMS DECLARATIONS ARE NOW REQUIRED FOR ALL CONSIGNMENTS

Currently, at the border, consignments less than €22 (£15) or lower do not require customs declarations.

THESE PRODUCTS ACTUALLY MAKE UP ALMOST 90% OF ALL GOODS ENTERING EUROPE

This new change could be challenging for logistics companies as the number of declarations are going to increase substantially in July. The number of declarations at the EU border is estimated to grow from 2 billion to 8 billion.

This potentially means slower processes at the border, late shipments, and packages being piled up in border warehouses due to missing or incomplete declarations. For maintaining smooth operations both logistics companies and sellers should implement automated platforms.

PaakPOD makes this easy for all our customers via our online portal. Clients can update all product information from anywhere as well as the necessary information for customs clearance.

The information required for our couriers to ensure smooth processing include the products commodity code, EORI numbers, and SKU numbers. We also have to include the exact value of goods as well as the weight or size and country of origin.

Until July 1st, postal consignments not exceeding a value of €150 can be declared for free circulation without a formal customs declaration. The same facility applies to non-postal consignments with a value not exceeding €22 (£15).

If you’d like to get more guidance for low-value consignments, the European Commission has prepared a guidance document on the importation and exportation of low-value consignments.

WHAT IS THE OVERALL IMPACT ON ECOMMERCE WITH THE NEW JULY 1ST BREXIT UPDATE?

If you are a UK business that sells goods to customers in the EU, you need to decide the best system for controlling your sales.

HERE IS A CHECKLIST OF ITEMS YOU SHOULD CONSIDER WITH THESE NEW JULY 1ST BREXIT CHANGES.

• Speak with VAT advisers to understand the exact VAT implications for your business

•Decide whether you want OSS/IOSS or if you prefer to file VAT returns in EU member states individually

•Display localised VAT on products

• Integrate total landed cost calculations into checkout

• Calculate your estimated costs for VAT if you typically sell goods to the EU below €150.

•Look into ways for automating customs declarations if you sell a lot of goods

PaakPOD is happy to answer any questions you may have concerning the new Brexit update. If you’d like assistance in automating your product fulfilment and all necessary documentation for customs clearance, we can set that up for you. Just schedule a completely free discovery call with us.